The leisure of state guidelines made lending that is usurious, but simple credit from Wall Street’s more reputable players managed to make it feasible and lucrative.

Today as Advance America’s co founder, William Webster, recounts to journalist Gary Rivlin in Broke, USA, it was Webster’s Wall Street connections he was in the Clinton administration, in the Education Department and then the White House that allowed his company to quickly dominate the market, growing from 300 stores in 1997 to more than 2,300. This season Advance America operated with $270 million in revolving credit sort associated with the company equivalent of credit cards mainly from Bank of America.

All told, banking institutions offered significantly more than $1.5 billion in credit to publicly exchanged payday lenders in 2010, relating to National People’s Action. The team identified Wells Fargo while the biggest payday lending financier; it backs five regarding the six biggest organizations. Customer advocates additionally stress that main-stream banking institutions are losing their skittishness about going into the market. At the least three banking institutions Wells Fargo, United States Bank and Fifth Third have actually explored bank checking account services and products that operate just like pay day loans.

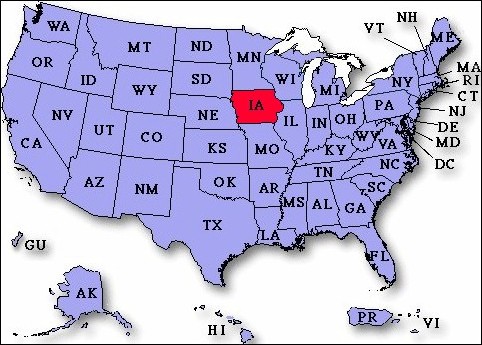

In certain methods, nevertheless, the industry is in retreat. Of all of the types of subprime lenders, it offers drawn the scrutiny that is most from lawmakers in the last ten years. Congress outlawed loans that are payday active responsibility service people in 2006, and also at minimum seventeen states have passed away rate of interest caps for cash advance payday loans.

Nevertheless the industry is going fast to adapt to the changing regulatory weather and watchdogs warn that state lawmakers and regulators could be astonished to look at exact exact exact same payday items under different names. “Pretty much any declare that tries to find the main point here of payday lenders, we come across some effort at subterfuge,” says Sara Weed, co writer of a Center for Responsible Lending report on what payday businesses evade state laws.

The issue is that a lot of states narrowly manage particular lending that is payday state, on what numerous loans a debtor usually takes in a provided period of time as opposed to placing broad boundaries regarding the array of high expense financing that dominates bad communities. Therefore loan providers have actually skirted brand new laws by simply making area modifications with their businesses that don’t change their core items: high price, tiny buck loans for folks who aren’t in a position to spend them right back.

“Our approach is always to continue steadily to make use of policymakers and grassroots businesses to give you a predictable and favorable legislative environment,” Advance America’s latest investor report describes. The industry’s growth era is finished, the report predicts, and so the business is targeted on growing its share of the market when you look at the thirty  states where payday loan providers run easily or where there clearly was “a regulatory framework that balances customer passions while permitting lucrative advance loan operations.”

states where payday loan providers run easily or where there clearly was “a regulatory framework that balances customer passions while permitting lucrative advance loan operations.”

Sc is the type of thirty states. The Blacks didn’t then know it, but once they retired to sc in 1999, they stepped in to the center of what exactly is possibly the many very charged battleground when you look at the war between regulators and payday lenders. As home to Advance America’s head office, their state is certainly among the industry’s most active markets. Payday loan providers made significantly more than 4.3 million loans in sc between 2006 and 2007 the same as almost one loan per state resident. Had the Blacks remained in nyc, one of many states with rate of interest caps for customer loans, they may have prevented the predatory lending traps that have actually mired them in constant anxiety. But Charleston is where Sam and Elsie Ebony was raised, as well as in their old age the town beckoned them right straight straight back.