Finances Till Payday specific loans need inexpensive charges for buyers with reduced credit ratings, however the company is actually without some adaptable applications more online loan providers offer.

Able to finance financial loans the future services opportunity.

Choice to change your installment time.

Smooth credit scores keep in touch with pre-qualification.

Offers guaranteed loan potential.

Fees origination costs.

Does not supply immediate remittance to lenders with debt consolidation reduction financing.

To judge finances Till Payday’s unsecured loans, all of us built-up higher than 40 information features through the financial institution, talked to company execs, validated relevant details alongside customer care reps and in addition examined the lending institution in addition to people appear the exact same visitors or render the identical personal mortgage item.

Finances Till Payday was an online loan provider program that provides specific debts to borrowers combined with sensible also bad credit history (689 and on occasion even lower FICO); the company points out many of their people need a credit score between 600 also 700. It needs beginning in addition to delinquent costs, but their debts need interest rate regular together with some other bad-credit debts.

Finances Till advance loan offer some versatile functions, just like the ability to modify your payment day plus the solution to shield the loan for a probably cheaper if not greater loan amount. In addition, it permits clientele to pre-qualify without influencing their credit report and research on-time monthly payments to any or all three major fico scores bureaus.

Mortgage conditions together with expenses may vary through condition.

Smooth debt review to pre-qualify: you will see the possibility financing number plus rates on an earnings Till cash advance payday loan if you pre-qualify. Pre-qualifying will not impact the credit file together with this may assist you know precisely how loan remittances match your month-to-month budget arrange before you choose into a difficult obligations query.

Guaranteed financing possibility: buyers can easily make use of a car to shield a person loan, which might get your a lesser APR or a greater mortgage levels. Never forget that in the event that you are amiss to remit on a protected financing, the loan company may recover your automobile. Any time you require your automobile to come to run, it will be really furthermore risky to use it guarantee.

Selection to change your settlement go out: finances Till Payday clients can alter their own financing’s remittance opportunity any kind of time moment, and there isn’t a constraint towards number of modifications, based on to a money Till Payday customer solution agent. Certainly not all loan providers utilize this mobility, which may getting beneficial if for example the payday corrections and/or you are taking on unique month-to-month duties.

Next-day financing: The fund providers mentions could quickly position the resources originating from a private mortgage straight into your bank account the day after the application is obviously accepted.

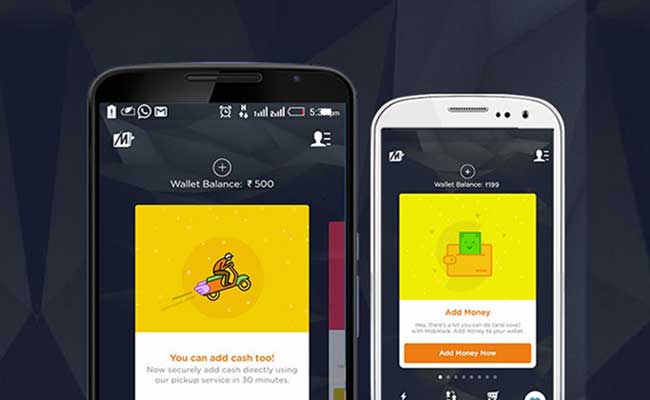

Portable app: Cash Till Payday has a mobile software that allows users making costs, readjust wages schedules as well as thought their unique payment record. Portable software may not be typical certainly one of on the web finance institutions.

?

CFPB: Online payday loans strike buyers with concealed possibility

Buyers just who seek out using the internet lenders for payday advance loan face hidden probability of costly financial costs and accounts closures, relating to a national review circulated Wednesday.

50 % of the borrowers just who got the high-interest financial loans web afterwards comprise hit with on average $185 in bank penalties for overdraft and non-sufficient resources charge whenever lenders presented one or more repayment demands, the buyer Investment cover agency assessment discovered.

1/3rd of this individuals who racked upwards a lender punishment eventually faced involuntary membership closures, the document furthermore receive.

Using the internet loan providers made repeated debit attempts on borrowers’ accounts, running up additional financial charge for any people, although the initiatives generally did not gather costs, the analysis stated.

“each one of these further outcomes of an on-line loan is considerable, and collectively they could impose big expenses, both physical and intangible https://www.getbadcreditloan.com/payday-loans-mi, that go far beyond the amount settled exclusively into original loan provider,” said CFPB manager Richard Cordray.

Obama pushes payday financing procedures in Alabama

The conclusions mark the customer service’s third analysis on the U.S. payday lending business that delivers the usually 300%-to-500%-interest-rate unsecured loans many low-income individuals count on to pay expenditures between one salary check as well as the further. The CFPB plans to point new guidelines for any loans later on this spring season, an attempt recommended by federal government.

CFPB analysts learned 1 . 5 years of information through the automatic cleaning residence. On line lenders typically make use of the economic circle to deposit loan continues into borrowers’ examining account, as well as to submit following payment demands.

If a borrower’s account balance are reasonable once the online loan provider directs a payment consult, the financial institution can come back the ask for non-sufficient resources or accept the consult. In any event, the lender may cost the borrower overdraft or non-sufficient funds charge, in addition to belated charge or came back repayment charges.

The study information showed that the $185 in typical bank charges your online payday loan borrowers provided an average $97 tacked on for a first not successful debit consult. The consumers additionally encountered an average $50 charge whenever on-line lenders generated the next debit request after an unsuccessful energy, and an average $39 cost whenever a lender published several payment demands on the same time.

Watchdog warns: cash advance costs can trap your

In every, 23per cent of account conducted by individuals exactly who got financing from online loan providers were apt to be shut towards the end for the 18-month test years, the assessment discover. The outcome was much more than the 6per cent most likely closure speed for bank accounts generally speaking, the report mentioned.

Notably half all pay day loan lenders render resources and find monthly payments on the web, the CFPB stated. Payday lenders that don’t supply on the web loan providers are not part of the evaluation.